MP Raises Devastating Family Farms Tax in Parliament

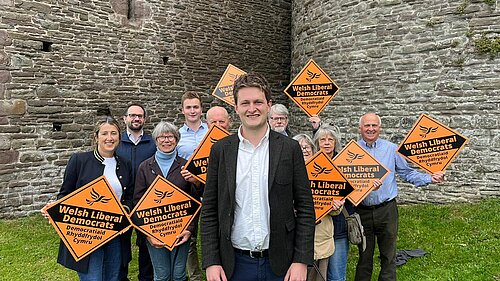

Welsh Liberal Democrat MP for Brecon, Radnor and Cwm Tawe has again today raised concerns over Labour’s family farms tax in Parliament.

As part of an investigation into the 2024 UK Government budget’s impacts on Wales, David Chadwick MP highlighted concerns from the agriculture sector that Labour’s changes to APR could devastate the family farm model and cause wider damage to the rural economy as a whole.

The intervention comes as the Institute for Fiscal Studies (IFS) has suggested that the Government change its proposals to farmland inheritance tax.

The NFU has contested the Treasury’s figures, stating the actual number of farms impacted is closer to 75% than the Treasury’s figure of 27%.

During the meeting, David Chadwick highlighted that many local farmers have contacted him and are ‘absolutely devastated’ that their children might struggle to run the family farm in the future because of Labour’s decision.

He also highlighted that the policy could destabilise the wider rural economy, with the impacts being felt in the agricultural supply chain and impacting the ability to tackle issues like depopulation which are already hitting rural communities hard.

In a meeting in Parliament last week, David Chadwick met with local farmers from Brecon, Radnor and Cwm Tawe to hear how the proposed changes would impact them and committed to continue to try to get the Labour Government to change their mind.

Commenting after the meeting, David Chadwick MP said:

“The Government used the IFS’s statistics to try and justify this disastrous policy. Now that the IFS has changed its mind so should the Government.

“It is very clear to me from what I have heard from local farmers across Mid Wales that this tax would devastate the family farms model and prevent the younger generation from farming.

“Labour needs to swallow their pride; realise the damage this family farm tax will do and axe the tax.”

ENDS

The full contribution can be watched here

Sign up

for email updates